Buying a house is a dream of almost every working class, businessman, or let's say, every individual. Many also dream of buying a house in the state's capital or a city that has some economic importance. For this, many opt for a housing loan. However, some people work hard over the years, save their money, and finally buy their dream house. At times, it becomes difficult to calculate how many years it will take to finally buy a house. Now, a recent study has answered this burning question for you, especially for those who want to buy their own house in Chandigarh and Ludhiana-

A recent study based on National Housing Bank (NHB) data has revealed just how many years of savings it would take for even the wealthiest 5% of urban households to buy a home in India's major cities, and the numbers may surprise you.

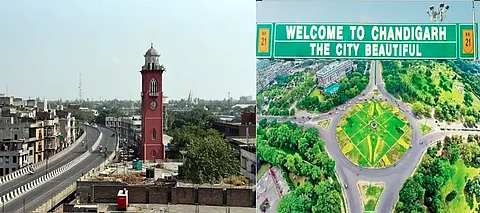

As per a Times of India report that quoted National Housing Bank (NHB) data, in Ludhiana, one of Punjab’s largest cities, it would take around 23 years of saving to afford a standard-sized home. Meanwhile, in Chandigarh, the Union Territory and capital of Punjab and Haryana, the situation is comparatively better, with top-earning families needing about 15 years of savings. In fact, the data establishes that Chandigarh is the most affordable capital of India in terms of buying a home.

The report compared household incomes with housing prices in 21 state capitals and major cities, measuring how long a family would need to save, assuming they put aside about 30.2% of their income annually, in line with India’s average savings rate.

While Mumbai tops the list as the country’s most unaffordable city (109 years of savings), Ludhiana and Chandigarh are among the more reasonable locations to own a home.

These figures highlight the increasing challenge of home ownership across India, even for well-off families. Though Ludhiana requires more time than Chandigarh, it still fares better than metros like Gurgaon, Bhubaneswar, and Mumbai, where housing has become nearly impossible to afford for most.

Chandigarh and Jaipur stand out as exceptions, cities where property rates still maintain some balance with income levels.

In a stark indicator of India’s growing housing unaffordability, even the wealthiest 5 percent of urban households in Maharashtra would need to save for more than a century, 109 years, to buy a house in Mumbai, according to a detailed study based on National Housing Bank (NHB) data.

The data hinges on comparing:

The monthly per capita consumption expenditure (MPCE) of the top 5 per cent of urban households in each state, sourced from official statistics.

The average carpet area price of a 110 square metre (1,184 sq ft) home in the state capital, based on NHB’s market data.