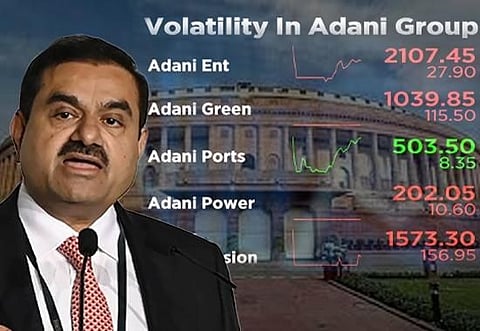

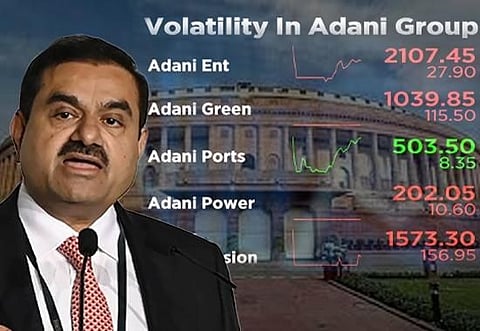

Ever since the release of the Hindenburg report on Adani’s alleged fraud the entire group has fallen into a catastrophe and with every passing day a new challenge is taking the conglomerate giant head on.

The tremors of the fall of shares in the stock market are taking their route towards the Indian Parliament and have brought the govt on its toes after opposition parties launched the scathing attack. Opposition Parties are of the view that the ruling BJP must open the gate for discussion on the Adani group, the Hindenburg report and the debacle that followed.

The parties' call in unison to constitute a Joint Parliamentary Committee, JPC for a detailed investigation, clearly implies the beginning of the politics over on the Adani empire coming from an American report. The big question is the trouble that Adani Group faces next, everyone around the world is eyeing the future of Adani Group, ranging from investors to the banks involved or the common people even.

But before we head on let us take a look over Gautam Adani who once stood as the world's 2nd wealthiest man is now doing all desperate attempts to save his giant empire that is slowly collapsing.

EARLY LIFE:

Born in a Jain family in Ahmedabad, Gujarat, Adani dropped out of college and moved to Mumbai as a teenager, working for a while as a diamond sorter in the gem trade. He returned to Gujarat in 1981 to help his elder brother Mahasukhbhai run a small-scale PVC film factory the family had acquired in Ahmedabad.

In 1988, he set up a commodities trading venture under Adani Exports and listed it on the bourses in 1994. The firm is now called Adani Enterprises.

BUSINESS EMPIRE

Starting off as a commodities trader in 1988, Adani started operating a port at Mundra on the Gujarat coast a decade later. He grew the business to become India's largest private-second port operator.

There was no looking back after that. He rapidly expanded his business empire into power generation, mining, edible oil, gas distribution and renewable energy. This came alongside the meteoric rise of Narendra Modi as the chief minister of Gujarat. Adani's business interests expanded into airports, cement and more recently media.

Adani has repeatedly denied getting any favourable treatment from Modi when he was a chief minister or now as Prime Minister.

Back to the current crisis:

Currently, looking at the present of the Adani Group, everyone is busy assessing the danger looming over the future. Although Hindenburg's report is behind the present crisis in the Adani Group, this has led to fresh talks and rumours and two kinds of theories have taken over the centre stage behind the crisis.

First, is that everything is happening under a big conspiracy to target the Adani Group, while the second theory is that the Adani Group has hidden much more than what it told about its empire. Now the controversy over the report on Adani Group has reached from Sensex to the country's Parliament. After all, what is the whole controversy? Presenting to you a detailed Explainer of the entire Hindenburg-Adani faceoff.

The Hindenburg report and fall of Gautam Adani:

The opposition is in attack mode against the ruling NDA-led BJP in the parliament which has led to the suspension of parliamentary proceedings for the day.

The Hindenburg's report on the Adani Group has already pushed Gautam Adani from the second richest person in the world to the 16th position. Adani Group has also decided to return the amount raised through the latest FPO.

Gautam Adani's journey is full of surprises, which is now rolling down from the peak and has caused massive outrage. The shares of Adani Group are falling every day in the stock market. Renowned foreign finance agencies are issuing warnings regarding the bonds of the Adani Group. The question is whether Gautam Adani will be able to save the falling reputation of his company due to the setbacks in the market or whether every passing day will bring a new challenge.

The political attack on BJP over Adani’s fraud in the Hindenburg report:

The Hindenburg report on Adani Group caused a loss of about 8 lakh crores to Adani Group. Those who invested in Adani Group suffered huge losses. The Congress alleges that Gautam Adani has committed the country's biggest corporate fraud.

Simplifying it, Congress is using the Hindenburg report as a weapon to attack the Modi government and its relationship with Adani which is under the radar for years. Congress has made a tremendous attack on Adani and Modi governments by using the Hindenburg report as a weapon.

Congress leader Randeep Surjewala, while sharing the cartoon of BBC, wrote that what did not happen in 75 years, the Modi government did it. LIC, which keeps its promise even with life and even after life, is itself insecure.

Although, Congress's attack on the BJP government regarding the Adani Group is nothing. Rahul Gandhi has been besieging the Modi government for a long time on the pretext of Adani and Ambani. Now, along with the Congress, all the opposition parties are openly attacking the Modi government over Gautam Adani’s debacle. Shiv Sena leader Priyanka Chaturvedi says that everything is a breakup.

RJD leader Manoj Kumar Jha claims that the Modi government is prostrated before Gautam Adani. As per the allegations of Samajwadi Party leader Ram Gopal, all the cash of the government bank was looted due to investment in the Adani Group. The coffers of the banks in the villages have become empty.

Adani Group has more assets than cumulative debt:

If we look at the investment reports of other banks, PNB has given a loan of about 7000 crores while SBI’s loan on Adani stands at a whopping 21000. The report coming out regarding investment and loans in Adani Group tells that there is a danger to the investors regarding investment, however, it is not that all the money will be drowned. Because Adani Group has more assets than debt on Adani Group as of today.

Gautam Adani's empire has been shaken in 9 days, he stood as the second richest person on the Forbes rich list, while in as many days he is out of the top 10 list. The shares of his companies, which skyrocketed once have now nose-dived.

The businessman who proved his mettle in front of the world had to issue a statement and withdraw the fully subscribed FPO. The story of the crisis on Gautam Adani begins on January 24, when America's short seller Riches firm Hindenburg accuses Adani. Although Adani is denying all the allegations.

7 big points behind Adani Group’s widespread deliberation around the world:

• Estimated loss of around Rs 8 lakh crore to Adani Group in the last 9 days.

• Gautam Adani's net worth has fallen by $24 billion to $64.7 billion.

• In the list of billionaires of the world, Gautam Adani fell down from number 2 to number 16.

• RBI has asked all the banks to give information about the loans given to Adani Enterprises.

• 9 out of 10 shares of Adani Group faced a massive decline.

• Adani Group talked about cancelling the fully subscribed FPO worth Rs 20,000 crore and returning the money to the investors.

• Gautam Adani was shocked by the report of the American research firm Hindenburg.

The time when the budget for the financial year 2023-24 was being presented in the country, while on the other hand, there was upheaval in the list of top billionaires of the world. It doesn't seem to be giving relief at the moment. The situation is such that their wealth is continuously declining.

Gautam Adani, who was in the second position on the list of billionaires of the world, has come to the 16th position today according to the real-time data of Forbes.

This tsunami has come to Gautam Adani's empire in just 9 days. Hindenburg published his report on the Adani Group on 24 January. The report claimed that the Adani Group has been openly involved in stock manipulation and account fraud for decades.

Experts call on the debt of Adani Enterprises:

Adani rejected Hindenburg's report outright and said that the company would take legal action against it. But in response, Hindenburg said that he stood by his report and would welcome legal action.

Finance expert Sharad Kohli. While talking with the media on the matter said that I do not see any rigging in this. Adani has a bank loan of 80 thousand crores. The debt of the company is around 2 lakh crores, this is a common thing.

There was an uproar in Parliament on Thursday regarding Hindenburg's report on the Adani Group. On the other hand, RBI has asked all the banks for information about the loans given to Adani Enterprises Limited.

Earlier late on Wednesday, the Adani Group talked about cancelling the fully subscribed FPO worth Rs 20,000 crore and returning the investors' money. On Wednesday, the stock of Adani Enterprises fell 26.70% to close at 2179.75.

This decline is believed to be the reason for withdrawing the FPO, but Gautam Adani gave a video message after cancelling the FPO, wherein he thanked the investors. Adani said that 'despite the ups and downs in the stock last week, your confidence in the company's business and its management is reassuring for us.